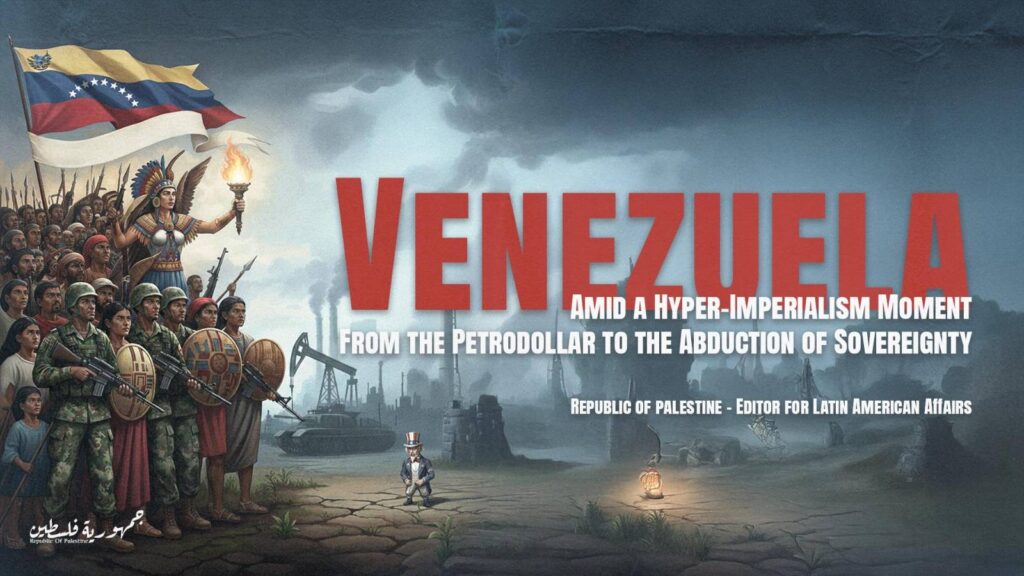

From the Petrodollar to the Abduction of Sovereignty

Republic of palestine – Editor for Latin American Affairs

Read in arabic

What has unfolded in Venezuela cannot be read as an isolated incident, nor as a passing episode in a conventional dispute between a “defiant” state and an enraged empire. What we are witnessing is a violent condensation of a global moment in which politics intertwines with economics, currency with force, and sovereignty with punishment. It is a moment in which imperialism is redefined—not merely as direct occupation, but as a comprehensive system for coercively managing the world when market mechanisms fail, persuasion is exhausted, and violence becomes the final guarantor of order.

Since the mid-twentieth century, U.S. hegemony has rested on two inseparable pillars: borderless military superiority and a global financial system that ensures permanent demand for the dollar. The 1974 agreement between the United States and Saudi Arabia to price oil exclusively in dollars was not a simple energy arrangement; it was the founding act of a new planetary order—the petrodollar system. This system allowed Washington to finance its deficits, its wars, and its global network of influence through a currency that does not obey the natural laws of the market, but rather the rules of power and coercion.

Within this equation, Venezuela was never just another oil-producing country. It was a structural anomaly is the system established by Washington. It holds the largest proven oil reserves in the world and, at the same time, chose—gradually yet with unmistakable political clarity—to exit the compulsory orbit of the dollar. Accepting the yuan, opening to the ruble and the euro, building payment channels outside the SWIFT system, and seeking accession to BRICS were not technical adjustments or neutral financial calculations. They were acts of sovereignty, carrying an explicit political message: breaking free from the regime of financial coercion.

Here is where the logic of punishment begins; Recent history makes clear that breaking the dollar’s monopoly over the energy market is not an “economic experiment,” but an imperial red line. When Saddam Hussein fell in 2003, that was not because of “weapons of mass destruction” that never existed, but rather because he considered selling oil in euros. As for Muammar Gaddafi when he proposed the gold dinar, he was not murdered because he was a “dictator,” but because he dared to imagine an Africa outside Western monetary hegemony. Each time, the narrative was ready: democracy, terrorism, drugs. And each time, the outcome was the same: oil returned to the dollar’s orbit, and the state was forced back into obedience.

What is happening in Venezuela today is the reproduction of this pattern—but under far more dangerous conditions. The world is no longer unipolar, and the petrodollar no longer enjoys the immunity it once did. Russia sells an increasing share of its energy in non-dollar currencies. China is constructing parallel payment systems. BRICS is evolving from an economic bloc into a project of monetary sovereignty. In this context, Venezuela—with its immense oil reserves—becomes a critical accelerator of de-dollarization, not a marginal actor that can be easily contained.

From this perspective, the military operation and the abduction of the Venezuelan president cannot be understood as a legal response to an alleged “crime.” They must be read as a strategic message addressed to the entire Global South, written in the language of force rather than law:

Liberation from the dollar is not an economic option—it is an act of insubordination, and it will be punished.

It is here that the contours of what can be called hyper-imperialism come into full view: a phase in which the empire no longer confines itself to governing through markets or diplomatic influence, but deploys a complex arsenal—sanctions, blockades, hybrid wars, legal piracy, elite recycling, and even direct military intervention—to reengineer the choices of states from within, while preserving the façade of “legality” and “democracy.”

Within this framework, political shifts across Latin America—including the rightward turn in Chile—cannot be understood as purely domestic phenomena. They are part of a broader regional recalibration that once again pushes the continent into the role of a “backyard.” Just as Chile served as an early laboratory for neoliberalism imposed by force in the 1970s, it is now being reshaped into a laboratory of soft electoral authoritarianism: a formal democracy whose policies aim to reassert control over resources and shrink the margins of sovereignty.

This trajectory cannot be separated from Palestine, which stands as the most complete model of contemporary colonialism. Just as Venezuela is today administered through sanctions, blockades, and financial piracy, Palestine is governed through naked force. In both cases, repression is marketed as a prerequisite for “stability,” the pursuit of sovereignty is criminalized, and submission is presented as the rational and responsible choice.

What we are witnessing is not the end of history, but an open collision between a system in decline and another that has yet to fully take shape. When an empire is forced to resort to military power to defend its currency, this is not a sign of strength, but an admission of crisis. And when the nations of the Global South see that those who step outside the dollar are bombed or abducted, the message may ultimately invert itself: liberation becomes an existential necessity, not a negotiable option.

Venezuela is not the beginning.

It is the signal of the end of a system that can no longer impose itself except through violence.

The open question today is not whether the world will change, but how much that change will cost, who will pay the price, and who will dare to pay it first.

(1) Hyper-imperialism: is the highest form of imperialism, representing a condition in which resources and markets are controlled through the military power of dominant states.